Traditional passive income options began to feel distant and disconnected. Stocks often felt abstract, real estate remained out of reach for many, and most alternatives lacked cultural relevance. Music, on the other hand, felt familiar, which naturally drew people to music rights investment marketplaces that offer smaller minimums, portfolio-level diversification, and predictable income exposure.

What truly changed was trust. Transparent streaming data, automated royalty accounting, fractional ownership, and built-in reporting dashboards removed much of the uncertainty that once kept investors away. Clear payout schedules, visibility into historical performance, and secondary liquidity options helped turn music from an emotional asset into one that could be evaluated with confidence.

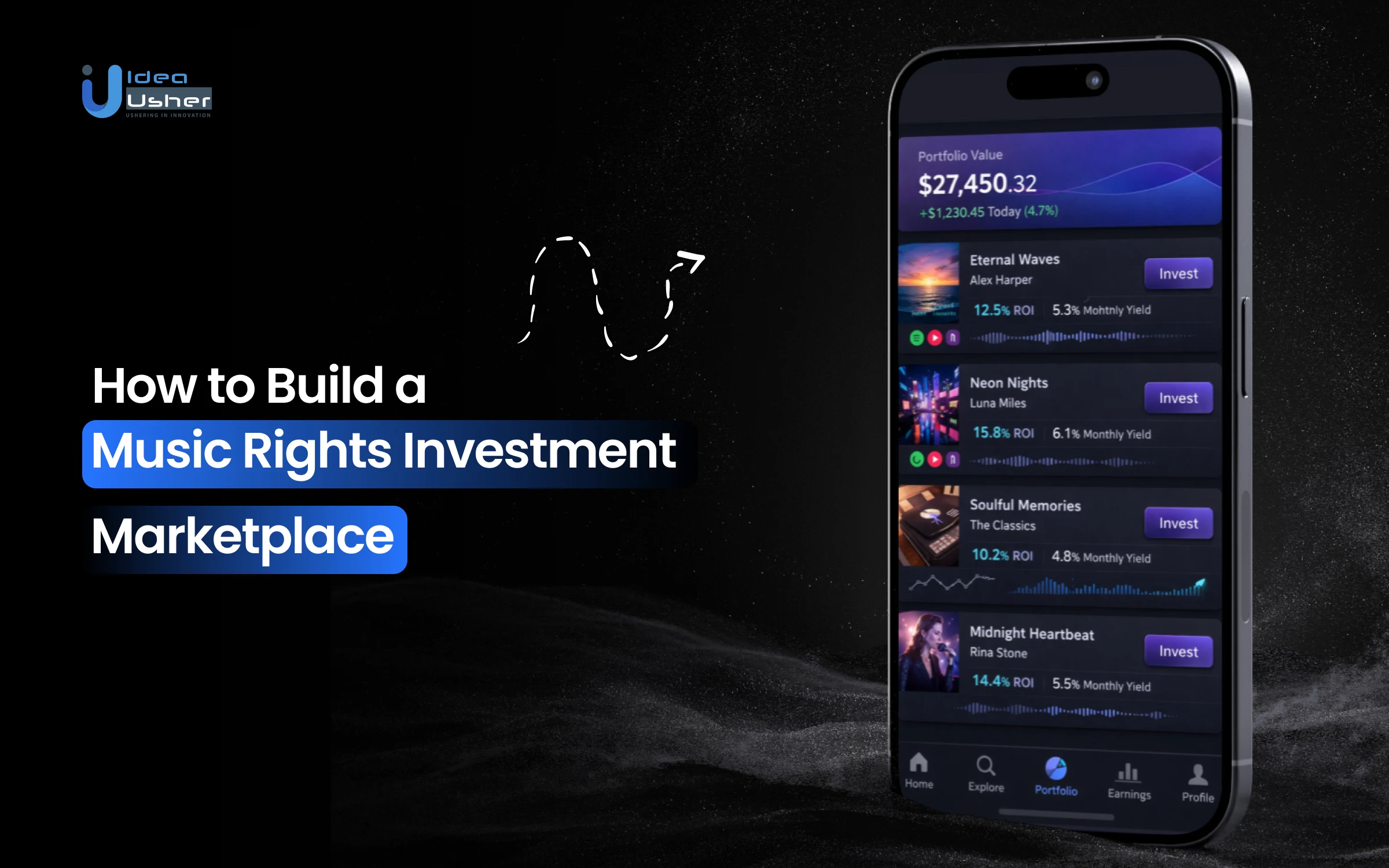

We’ve built several multiple music rights investment solutions over the years, powered by blockchain-based digital asset infrastructure and royalty data orchestration systems. Given our expertise, we’re sharing this blog to outline the steps to develop a music rights investment marketplace. Let’s start!

Key Market Takeaways for Music Rights Marketplaces

According to VerifiedMarketReports, the music rights market is steadily gaining traction as an investable category. With revenues around USD 25 billion in 2024 and long-term projections pointing to USD 45 billion by 2033, growth is driven by the durability of streaming and sustained demand for established catalogs. This environment favors marketplaces that allow investors to participate in royalty income without the complexity or capital burden of acquiring entire catalogs.

Source: VerifiedMarketReports

What makes these marketplaces relevant is the alignment of incentives on both sides. Investors are looking for assets that generate recurring cash flows and behave differently from stocks and bonds.

Artists and catalog owners, meanwhile, want flexible liquidity without giving up full ownership. By breaking rights into smaller, investable portions and standardizing how income is reported and distributed, these platforms are making a traditionally opaque market far more approachable.

Platforms like JKBX and Royalty Exchange illustrate how this shift is playing out. JKBX offers a market-style experience, allowing investors to buy fractional royalty shares in songs or baskets with relatively low minimums, under a regulated structure.

Royalty Exchange, on the other hand, operates as a long-established auction marketplace where rightsholders sell future royalty streams, and investors access a wide mix of songs and catalogs.

What Is a Music Rights Investment Marketplace?

A music rights investment marketplace is a digital platform that allows investors to buy fractional ownership in music royalties rather than full catalogs. It uses verified royalty data to track income from streaming and licensing, and automatically handles rights validation and payouts. This structure turns ongoing music consumption into a clear and investable revenue stream.

Types of Music Rights Traded

Music rights marketplaces trade songwriting rights, master recording rights, and usage-based royalty rights. These assets may generate income from streaming, public performance, and licensed usage. The structure enables clear revenue tracking and automatic payouts.

1. Songwriting and Publishing Rights

These rights relate to the composition of a song, including lyrics and melody. When traded on a marketplace, investors earn income from mechanical, performance, and synchronization royalties. This type of right is often seen as stable because songs can be recorded and performed by multiple artists over time.

2. Master Recording Rights

Master rights represent ownership of a specific sound recording. Revenue comes mainly from streaming platforms, downloads, and licensing deals tied to that recording. Investors usually prefer masters with a proven track record of streaming because historical data can clearly indicate future income patterns.

3. Mechanical Royalty Rights

Mechanical rights generate revenue whenever a song is reproduced digitally or physically. In a marketplace setting, these rights are valued for their predictable payout structure driven by streaming volume. They are often bundled into portfolios to smooth revenue fluctuations.

4. Performance Royalty Rights

These rights produce income when music is played publicly, such as on radio, television, live venues, or digital platforms. Marketplaces track these royalties through collection societies and automatically distribute earnings. Investors value them because consumption data can be monitored consistently.

5. Synchronization Rights

Synchronization rights apply when music is licensed for use in films, advertisements, games, or online content. While payouts may be less frequent, they can be significantly higher per deal. In a marketplace, these rights are often treated as upside-driven assets layered on top of steady royalty income.

How Do Music Rights Investment Marketplaces Work?

Music rights investment marketplaces take verified royalty assets and structure them into fractional units that investors can buy with clarity. The platform can track streaming and licensing revenue and will distribute payouts automatically through secure systems. This approach quietly turns complex rights management into a predictable and data-driven investment flow.

1. Asset Acquisition and Onboarding

The process begins when rights holders such as artists, labels, publishers, or catalog funds offer their royalty streams for investment.

- Due diligence and verification are conducted to confirm ownership, verify a clean title with no disputes, and assess historical royalty performance.

- AI-powered valuation models forecast future earnings using streaming trends, audience growth, genre longevity, and sync demand, rather than relying onsimple revenue multiples.

The asset is then legally structured, often through an SPV or regulated digital security, making it ready for fractional ownership.

2. Fractionalization and Tokenization

This stage enables broader investor access.

- Ownership rights are divided into fractional units, such as shares or tokens, each representing a portion of future royalty income.

- Blockchain-based smart contracts are often used to record ownership, automate compliance checks, and maintain an immutable transaction history.

The offering is structured under regulatory frameworks such as Reg A Plus or Reg CF, with built-in investor eligibility checks and limits.

3. Investor Access and Trading

Once live, the marketplace opens to eligible investors.

In the primary offering, investors purchase fractional ownership through a dashboard that mirrors a brokerage or fintech app.

Some platforms also support secondary market trading, allowing investors to buy and sell their positions internally, which introduces liquidity and real-time price discovery.

4. Royalty Collection and Distribution

This layer powers predictable cash flow. The platform aggregates royalty data through integrations with streaming services, performance rights organizations, and licensing partners.

- Revenue verification systems validate incoming data before payouts are triggered.

- Smart contracts automatically distribute royalties to investors based on ownership share, often with faster settlement than traditional royalty accounting.

5. Ongoing Management & Value Enhancement

Modern platforms go beyond administration.

Investor dashboards provide visibility into streaming growth, earnings trends, and projected returns. Some marketplaces actively optimize catalog performance by supporting sync licensing, promotional strategies, and audience expansion.

Community and fan engagement tools allow investor-fans to promote tracks they own, reinforcing discovery and long-term revenue growth.

How to Build a Music Rights Investment Marketplace?

A music rights investment marketplace is built by first securing verified ownership and reliable royalty data because trust must exist before scale. Valuation logic and fractional ownership can then be layered to enable transparent participation for investors.

Our team has developed several music rights investment marketplaces over time, and this is how we do it.

1. Rights Ingestion

We begin by setting up a clean rights intake process. Our systems verify copyright ownership through a structured chain-of-title review before any listing is made. We design onboarding workflows for artists and labels that accurately capture contracts and metadata. This ensures only verified rights enter the marketplace.

2. Royalty Data Layer

Next, we build the revenue backbone. We integrate with DSPs and PROs to pull royalty data directly from the source. Our normalization and reconciliation logic consistently reports across platforms. Real-time pipelines keep performance data current.

3. Valuation Engine

This layer adds financial intelligence. We implement revenue-forecasting models using historical streaming data. Risk and volatility scoring help quantify uncertainty. Asset pricing updates dynamically as performance trends change.

4. Fractional Ownership

We then enable fractional investing. Ownership ledgers track every share of a music right with precision. Smart contracts automate revenue splits so payouts follow predefined rules. This keeps distributions transparent and reliable.

5. Investor Layer

Here, we focus on usability and liquidity. Asset dashboards present rights data in a clear, structured format. Buy-and-sell flows are optimized for stability. Secondary market mechanics support trading while maintaining pricing integrity.

6. Compliance and Monitoring

Finally, we secure the platform for scale. KYC and AML checks run smoothly in the background. Fraud detection systems monitor abnormal activity. Audit and reporting layers support regulatory reviews and long-term governance.

Revenue Potential of a Music Rights Investment Marketplace

A music rights investment marketplace can generate significant revenue because it operates within a global music rights economy valued at over $40 billion and continues to expand through streaming. These platforms may quietly convert royalty flows into structured financial transactions that scale with volume rather than market timing.

The most successful platforms typically generate 8 to 20 percent of total transaction volume as annual revenue, with leading players reaching $10 to $50+ million in annual revenue within 3 to 5 years.

Primary Revenue Streams

1. Transaction Fees and Commissions

Platforms usually charge 3 to 10 percent per transaction when music rights are bought or sold. Fees may apply to buyers, sellers, or both.

| Platform | Fee Structure | Transaction or Asset Size | Revenue Generated |

| Royalty Exchange | 10 to 15 percent seller success fee plus 10 percent buyer premium | $1 million catalog sale | $200,000 to $250,000 per transaction |

| SongVest | Around 5 percent from sellers and 2 to 3 percent from buyers | $25,000 average transaction | $1,750 to $2,000 per deal |

| Hipgnosis Songs Fund | 2 to 3 percent annual management fee | $2.5 billion portfolio | $50 to $75 million annually |

2. Asset Management and Administration Fees

Platforms charge 0.5 to 2.5 percent annually on assets under management for royalty collection, reporting, and payout services.

- Primary Wave reportedly charges 15-25% of royalty income for active management.

- Royalty Flow operates at approximately a 1-2 percent annual fee on managed royalty value.

- A platform managing $100 million in assets can generate $1-$2.5 million in annual management fees.

3. Listing and Marketing Fees

Rights holders often pay upfront fees to list and promote their catalogs.

- MusicBull charges $499 to $2,999 for premium listings and promotions.

- Sonomo uses tiered pricing, with premium catalogs costing $5,000 or more.

- Tangy Market offers featured placement bundles starting at $1,500.

Secondary Revenue Opportunities

4. Premium Data and Analytics Services

Advanced analytics subscriptions can generate steady, recurring revenue for platforms serving serious investors and rights holders. Viberate charges $99 to $499 per month for premium data access, showing a clear willingness to pay for insights.

A focused rights platform could generate $500,000 to $2 million annually from 500 to 1,000 subscribers paying $100 to $200 per month.

5. Financing and Advance Services

Platforms can generate additional income by offering advances against future royalty flows, where fees and interest are built into the repayment structure. These advanced models typically include 10 to 20 percent in fees, depending on risk and duration.

A $10 million advance portfolio can realistically produce $1 to $2 million in annual revenue through structured repayments and interest income.

6. Technology Licensing & White Label Solutions

Licensing marketplace technology can unlock high-margin recurring software revenue for the platform. Institutional white-label deployments typically range from $250,000 to $1 million in setup fees, with 15-30% annual maintenance fees.

Blockchain-based royalty systems and smart contract integrations can further add $50,000 to $200,000 per implementation as one-time or phased technical engagements.

Market Size and Growth Outlook

- The global music publishing market reached $9.8 billion in 2023 and is projected to hit $13.5 billion by 2028, growing at a 6.5 percent CAGR.

- Fractional ownership activity has grown by more than 300 percent since 2020.

- Secondary market trading volume increased from $150 million in 2021 to over $500 million in 2024.

- Leading platforms are seeing transaction volumes double year over year.

Cost Structure and Profitability

Well-run platforms operate at gross margins of 60 to 75 percent after royalty payouts.

- Technology infrastructure: 15 to 25 percent of revenue

- Legal and compliance: 10 to 20 percent

- Marketing and acquisition: 20 to 35 percent

- Operations and support: 15 to 25 percent

Platforms that cross $10 million in annual revenue often achieve 25-40 percent EBITDA margins, with mature players reaching 50 percent or higher as scale increases.

Valuation Multiples and Investor Returns

Music rights marketplaces command premium valuations due to recurring revenue and strong network effects.

- Revenue multiples of 6 to 12x for established platforms

- EBITDA multiples of 12 to 20x for profitable high-growth platforms

- A platform generating $20 million annually may be valued at $120 to $240 million

How are Copyright Disputes Handled after an Asset goes Live?

For investors, copyright disputes are among the most material and underrecognized risks in music rights investing. Once a song or catalog goes live on a marketplace and fractional ownership is sold, any ownership challenge can freeze royalty flows, reduce asset valuation, and trigger lengthy legal processes that directly affect returns.

A mature music rights investment marketplace does not treat disputes as edge cases. It engineers preventive, financial, and legal systems upfront so that disputes can be contained and resolved with minimal disruption to investors.

1. Prevention Through Pre-Listing Audits

The strongest protection against disputes begins before an asset is ever listed.

- Full title and chain-of-title verification is conducted by legal teams using rights management software. Ownership is traced across songwriter splits, publisher agreements, master recordings, and historical transfers to ensure there are no missing links or ambiguous claims.

- AI audio fingerprinting systems are increasingly supporting sample- and interpolation-clearance audits. These tools scan tracks against global reference databases to detect uncleared samples or melodic overlaps that could later trigger infringement claims.

- Dispute history reviews assess whether the artist, label, or publisher has been involved in prior litigation or recurring ownership challenges.

At this stage, platforms typically secure representations and warranties from sellers, along with indemnity provisions that shift financial liability to sellers if misrepresentation is later discovered.

2. Structural Safeguards Escrow Insurance

Even with strong due diligence, disputes can still arise. Advanced platforms prepare for this structurally.

- Royalty escrow mechanisms withhold a defined percentage of incoming royalties for a fixed post-listing period. These funds act as a buffer to absorb claims without immediately impacting investor payouts.

- Music title insurance is emerging as a critical layer of protection. Specialized insurers underwrite policies that compensate investors if ownership claims invalidate part or all of the asset.

- Dedicated legal reserve funds are maintained at the platform or SPV level. This ensures legal costs are covered without diluting royalty distributions or forcing emergency capital calls.

3. Detection and Response

Once an asset is live, speed and visibility become critical.

- Automated claim monitoring systems integrate with copyright registries, licensing databases, and digital platforms to flag ownership challenges or monetization disputes as they occur.

- Investor communication protocols ensure immediate disclosure through dashboards and formal notifications. Investors are informed about the nature of the claim, the affected revenue streams, and the expected resolution timeline.

- Revenue segmentation controls allow disputed income streams to be isolated and redirected to escrow, while unaffected royalties continue to flow normally.

4. Resolution Pathways

Dispute resolution depends on platform design and asset structure.

| Mechanism | Process | Advantage |

| Internal dispute resolution | Platform-led mediation or arbitration with copyright specialists | Faster resolution and lower cost |

| Smart contract pause and redirect | Automated rerouting of disputed royalties to escrow | Transparent and rules-based enforcement |

| On-chain arbitration | Decentralized juror-based dispute resolution | Jurisdiction-neutral and tamper-resistant |

| Traditional litigation | Court proceedings initiated by the SPV | Legally binding outcomes for complex cases |

The goal is always to resolve disputes without destabilizing the asset or eroding investor confidence.

5. Investor Protection and Exit Planning

Credible marketplaces plan for adverse outcomes.

- Buyback provisions may require the seller or platform to repurchase investor positions if a dispute materially impairs the asset’s revenue potential.

- Secondary market controls allow temporary trading halts during active disputes to prevent panic-driven price volatility.

- Immutable transparency records log all dispute-related actions, financial impacts, and communications. This creates a permanent audit trail that strengthens trust and regulatory defensibility.

How Does a Platform Prevent Royalty Dilution after Listing?

Royalty dilution is a key risk in music rights investing. Once an asset is listed, each investor’s returns depend on the continued integrity of the royalty stream. To protect value and trust, professional marketplaces design systems from day one that prevent and monitor dilution before it impacts revenue.

1. Pre Listing Structuring

Prevention begins before a single share is sold, through rigorous legal and technical structuring.

Clear and Frozen Splitsheets

Before listing, all ownership percentages among songwriters, producers, performers, and publishers are legally finalized and encoded into the asset’s smart contract or SPV operating agreement. No future changes are permitted without investor approval.

Encumbrance Free Title Guarantee

Comprehensive audits confirm the absence of liens, unpaid advances, or contingent rights that could later introduce new claimants into the royalty stream.

Sample and Interpolation Clearance

Full clearance reports verify that all samples and interpolations are properly licensed and compensated, eliminating the risk of future catch-up royalty claims.

2. Smart Contract Enforcement

Blockchain-based marketplaces rely on programmable logic to lock royalty economics.

Immutable Split Parameters

Royalty distribution percentages are hardcoded into smart contracts. Even if off-chain agreements change, on-chain payout logic remains unchanged unless a predefined governance process is completed.

Automated Payment Routing

Royalties from DSPs and PROs are deposited directly into the asset’s dedicated wallet and automatically distributed to investors. This eliminates manual handling and fund commingling risks.

Time-Locked Governance Controls

Any proposal to modify splits requires a tokenholder vote with high quorum thresholds and is subject to a mandatory review period of 30 to 90 days.

3. Continuous Monitoring and Alert Systems

After listing, dilution risks often arise from external and operational sources.

Real Time Royalty Auditing

AI-driven systems compare expected earnings with actual deposits and flag discrepancies that may signal misreporting or unauthorized deductions.

Claim Detection Feeds

Integrations with copyright dispute databases alert platforms to new ownership claims or conflicts that could affect revenue.

Investor Transparency Dashboards

Every royalty payment is traceable from source to asset wallet to investor wallet. Unexplained reductions are highlighted automatically.

4. Reserve Mechanisms & Insurance Backstops

Advanced platforms incorporate financial safeguards to absorb unexpected dilution events.

- Royalty Escrow Reserves: A small percentage of royalties, such as three to five percent, is held in reserve for a fixed duration to cover clawbacks or corrections without impacting distributions.

- Dilution Insurance Pools: Some platforms work with specialty insurers to compensate investors if dilution crosses a predefined threshold due to legal or ownership disputes.

- Buyback Provisions: In severe cases, platforms or original sellers may agree to repurchase investor shares at fair value if irreversible dilution results from pre-listing failures.

5. Structural Protections Against Silent Dilution

Not all dilution is legal. Some erosion occurs through operational inefficiencies.

- Fixed-Fee Models: Platform fees are set as flat, transparent percentages, preventing unpredictable erosion of investor returns.

- Multi-Currency Hedging: Automated hedging mechanisms reduce foreign exchange losses between royalty collection and payout.

- Gas Optimization for Micro Payouts: Layer-2 networks and batched transactions help ensure transaction costs do not overwhelm small royalty distributions.

Top 5 Music Rights Investment Marketplaces

We did some digging and found a few strong music rights investment marketplaces that actually stand out for how they structure ownership and payouts. Each platform takes a slightly different technical approach to handling royalties and investor access.

1. Bolero Music

Bolero Music offers access to fractional music catalog investments backed by verified royalty data. Investors can track earnings performance through built-in reporting tools. The platform aims to simplify complex rights ownership into a digital, investable format.

2. Music Royalties Inc.

Music Royalties Inc. aggregates high-value music catalogs into structured investment offerings. Investors gain exposure to established royalty income without managing individual rights. The platform positions music royalties as a long-term alternative asset.

3. JKBX

JKBX focuses on turning music royalties into tradable financial instruments. It allows investors to buy royalty shares tied to specific songs or collections. The experience is designed to feel closer to equity trading while remaining royalty-backed.

4. JIS Platform

JIS Platform converts music royalties into tradable assets with structured payout mechanisms. Investors can earn recurring income linked to actual music usage data. The platform emphasizes liquidity and standardized asset formats.

5. Royal.io

Royal.io allows fans and investors to buy limited royalty shares directly from artists. Ownership grants a percentage of streaming revenue while keeping rights management automated. This model blends artist funding with compliant royalty participation.

Conclusion

Music rights investment marketplaces represent a significant shift in how digital assets are owned and traded. When you look closely, this model can quietly merge media IP with fintech infrastructure that behaves like a regulated financial system. Businesses that move early may steadily build trust, liquidity, and data advantages while the market is still forming. Over time, the platform could compound value through recurring royalties, secondary trading, and transparent reporting. If executed carefully, this category should evolve into long-term infrastructure rather than a short-term trend.

Looking to Develop a Music Rights Investment Marketplace?

IdeaUsher can help you design a compliant music rights marketplace from the ground up with clear ownership logic and auditable revenue flows. We may build the platform with secure trading systems, royalty tracking engines, and automated payouts that scale reliably.

Why Build With Us?

- 500,000+ Hours of Coding Excellence – Scalable, secure, and future-proof architecture.

- Ex-MAANG/FAANG Developers – Who understand building at scale for millions of users.

- End-to-End Build – From smart contract audits and predictive AI models to real-time dashboards and regulatory compliance layers.

- Proven in Action – We’ve delivered complex platforms in DeFi, media, and Web3.

Work with Ex-MAANG developers to build next-gen apps schedule your consultation now

FAQs

A1: Building a music rights investment marketplace usually begins with defining which rights can be listed and how ownership is represented. You should design systems for rights verification, royalty data ingestion, and investor onboarding. Automated payout logic and reporting may then be added. When building the marketplace can scale without breaking trust.

A2: The cost depends on the depth of platform compliance and automation. A lean version may focus on catalog listing and payout distribution. More advanced marketplaces can include valuation engines and secondary trading. Costs often increase as data integrations and regulatory safeguards expand.

A3: Core features often include fractional ownership of rights, transparent earnings dashboards, and automated royalty distribution. Marketplaces may also provide historical performance views and investor reporting. Rights validation tools help ensure accuracy. These features together support confident participation.

A4: These marketplaces work by acquiring or onboarding verified music rights and splitting them into investable units. Royalties flow in from streaming and licensing sources. The platform then calculates earnings and automatically distributes payouts. Investors can monitor performance through dashboards.